International Indirect Tax Manager

工作概要:

About the Role & Team

Be you, be here, be part of the story!

At The Walt Disney Company, magic is more than just a word; it's a way of life. For a century, we've been inspiring imaginations, celebrating diversity, and bringing families together through our beloved stories, characters, and experiences. From our iconic theme parks and resorts to our groundbreaking films, television shows, interactive media and products, we're dedicated to creating magic that knows no bounds.

We are looking for an enthusiastic International Indirect Tax Manager to make a meaningful impact and be part of a dynamic team. Join us in shaping the magic behind the scenes!

The Indirect Tax Manager will support the Principal International Indirect Tax on compliance, advisory and legislative matters for supporting all of Disney line of businesses. The role will encompass indirect tax advisory, VAT audit support, tax legislation updates and The Walt Disney Company’s (“TWDC”) technology and tax digitalization strategy.

The successful candidate will act as an Indirect Tax liaison with a number of our business and finance partners to ensure that ongoing and new business requirements are appropriately supported from both an advisory and VAT reporting perspective. Disney’s International footprint encompasses a number of diverse businesses which include but are not limited to TV and film production, licensing, broadcasting, Disney+ D2C streaming, retail, travel, cruise lines and theme parks. The successful candidate should have industry experience in several of these sectors in order to act as the VAT subject matter expert supporting the relevant businesses.

Disney has operations or makes direct to consumer sales into multiple countries worldwide and so hands-on experience of working in a Big 4 or Multinational tax team advising on cross border supplies of goods and services is critical. Disney is also enhancing its relationship with external managed services providers (MSP) and so experience of partnering with an MSP either from within a Big 4 environment or from a recipient of MSP services would be extremely advantageous.

The Indirect tax team are also responsible for monitoring and ensuring compliance with global Digital Service Taxes and so experience of DST’s is helpful but not essential. Similarly, as the global requirement for digitised invoicing and e-reporting rapidly increases, experience of implementations with third-party e-invoice/ reporting would be favourable.

Please Note: This is an office-based role. 4 days working in the Hammersmith, London office with 1 day working from home (Monday or Friday).

What You Will Do

Business Partnering

Providing ongoing VAT advice and training (where applicable) to the various Lines of Business (licensing, retail, travel, cruises, production), accounts payable and to Disney’s internal and external Shared Service Centres

Support the Principal and Senior Manager, International Indirect Taxes and our businesses to fully understand all commercial initiatives, evaluating business models, effectively structuring and suggesting potential solutions or changes to supply and contractual flows to manage risks, costs and maximize opportunities

Working with other members of Disney’s International finance and business teams considering the local country operations, reviewing commercial initiatives across the region and work with the Principal/ Senior Manager to ensure the operations are structured appropriately and have the correct processes and controls from an indirect tax perspective

Compliance

Although primarily this is not a compliance focused role, certain VAT compliance tasks will be required which include but are not limited to:

Occasional review of VAT returns as required

Requesting new tax codes and other tax master data attributes

Arranging the payments for VAT liabilities, including obtaining the necessary approvals

Support with the preparation of information for and coordination of VAT audits

Review and submission of EU VAT refund and 13th Directive VAT refund claims

Experience of Alteryx would be helpful.

Tax Environment changes

Pro-actively work with advisers and other stakeholders to monitor local, EMEA and Global tax legislation changes, working with Principal and Senior Manager IDT to appropriately manage these changes

Work with the Principal and Senior Manager Indirect Taxes on implementing Tax technology initiatives such as digital reporting and e-invoicing.

Act as one of TWDC’s focal points for identifying changes in legislation such as SAF-T, SII, Making Tax Digital and split payments. Responsibilities include liaison with the overall Project Manager and other business stakeholders to ensure all tax legal and reporting requirements are delivered.

Training

Supporting Disney global stakeholders on an ongoing basis with training and technical advice

Writing material and undertaking training for in-house staff on VAT technical matters

Team

Work closely with other international tax colleagues in supporting cross-over work i.e. Film and TV, business restructuring, new business initiatives production entity support and PSA reporting.

Required Qualifications & Skills

Significant indirect tax experience preferably including international and domestic supplies of goods and services

Experience of advising on the VAT treatment of electronically supplied services is desirable

Experience of advising in the following industries is helpful: travel, international transport/ cruise lines, online retail

CTA or equivalent qualification

Strong Accounting and VAT reporting background in a multinational environment

Awareness of VAT and associated reporting obligations across multiple jurisdictions

Experience in ERP systems (particularly SAP), Alteryx and Excel is highly desirable as is involvement in systems transformations projects

Strong organizational skills and ability to manage multiple deadlines to deliver

Analytical and problem-solving skills with ability to make decisions and recommendations

Able to manage workload to tight deadlines and prioritize multiple tasks and work streams

companies

Strong working knowledge of Indirect Tax compliance processes, from data extraction to return submission with focus on data integrity and global compliance automation and process solutions.

Strong interpersonal skills to establish effective working relationships at all levels of the organisation

The Perks

25 days annual leave

Private medical insurance & dental care

Free Park Entry: You will have the opportunity to enter any of our parks with your family and friends for free

Disney Discounts: you are entitled to discounts on designated Disney products, resort F&B and ticketing

Excellent parental and guardian leave

Employee Resource Groups – WOMEN @ Disney, Disney DIVERSITY, Disney PRIDE, ENABLED, and our Mental Health & Wellbeing Group, TRUST.

The Walt Disney Company is an Equal Opportunity Employer. We strive to be a diverse workforce that is representative of our audiences, and where all can thrive and belong. Disney is committed to forming a team that includes and respects a variety of voices, identities, backgrounds, experiences and perspectives.

關於The Walt Disney Company (Corporate):

在 The Walt Disney Company (Corporate),你會看到公司強大品牌背後各業務如何融會交流,建構出全球最創新、影響深遠和備受尊崇的娛樂公司。作為企業團隊的一份子,你將會與推動策略以讓The Walt Disney Company穩佔娛樂界頂尖地位的世界精英領袖一同工作。與其他具有創新精神的思想家惺惺相惜,同時讓這個世界上最偉大的故事敍述家為全球各地千百萬家庭締造回憶。

關於 The Walt Disney Company:

Walt Disney Company 連同其子公司和聯營公司,是領先的多元化國際家庭娛樂和媒體企業,其業務主要涉及三個範疇:Disney Entertainment、ESPN 及 Disney Experiences。Disney 在 1920 年代的起步之初,只是一間卡通工作室,至今已成為娛樂界的翹楚,並昂然堅守傳承,繼續為家庭中每位成員創造世界一流的故事與體驗。Disney 的故事、人物與體驗傳遍世界每個角落,深入人心。我們在 40 多個國家/地區營運業務,僱員及演藝人員攜手協力,創造全球和當地人們都珍愛的娛樂體驗。

這個職位隸屬於 The Walt Disney Company Limited,其所屬的業務部門是 The Walt Disney Company (Corporate)。

The Walt Disney Company Limited 是提供平等機會的僱主。考慮是否聘用求職者時,將不論其年齡、種族、膚色、宗教或信仰、性別、國籍、族裔或民族血統、性取向、變性、婚姻或同性伴侶狀況、殘疾或懷孕或生育狀況。Disney 培養商業文化,所有人的想法和決策都有助我們發展、創新、創造最好的故事,並與瞬息萬變的世界息息相關。

遇到技術問題?查看常見問題以尋求協助。

招聘流程

-

您的故事從哪裡開始?

探索 Disney 職位空缺和 The Life at Disney 網誌,了解華特迪士尼公司有待發掘的所有精彩機會。

-

迪士尼的故事裏,有你更精彩成就迪士尼故事

有許多不同品牌和業務可供探索。當您找到適合您的機會後,請填寫您的申請,進行下一步。

-

下一章

申請後,您將收到一封電子郵件,讓您可存取應徵者控制面板。建立您的登入資料,並確保經常檢視您的控制面板,以查看申請進度。

探索此地點 EMEA

Disney EMEA 旨在透過在 29 個國家的辦事處在 59 個市場營運的超過 6,000 名員工團隊在極其多樣化的多個國家推動增長、創新和品牌親和力。

我們的文化

相關內容

-

-

-

-

-

-

-

員工故事 Life at Disney 網誌

員工故事 Life at Disney 網誌 -

-

-

-

-

-

-

-

-

-

事業發展 求職者資源

事業發展 求職者資源 -

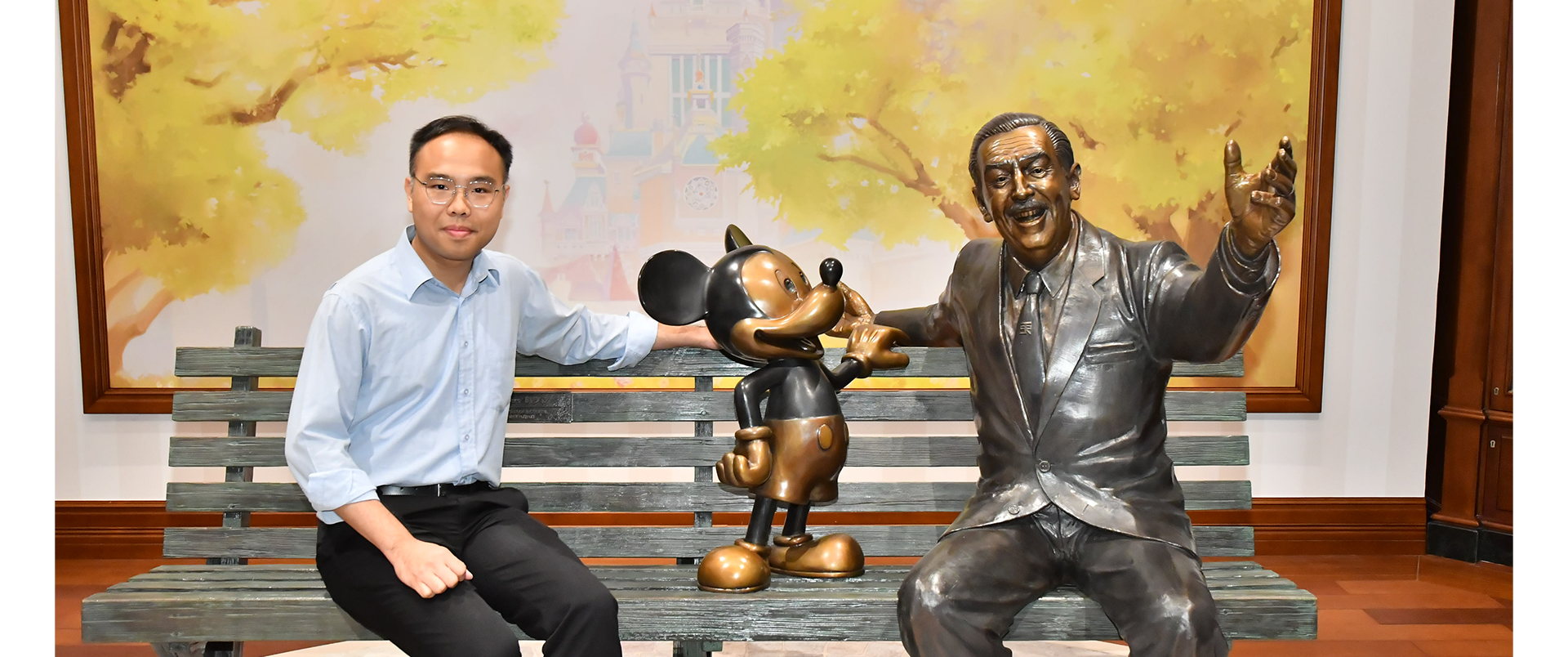

多元、公平與包容 文化與價值觀 員工故事 工作與創新 學生及應屆畢業生 Life at Disney: Hong Kong Disneyland Resort

多元、公平與包容 文化與價值觀 員工故事 工作與創新 學生及應屆畢業生 Life at Disney: Hong Kong Disneyland Resort -

工作機會 員工故事 學生及應屆畢業生 A Dream to Perform Comes True for a Disney Intern at Hong Kong Disneyland

工作機會 員工故事 學生及應屆畢業生 A Dream to Perform Comes True for a Disney Intern at Hong Kong Disneyland -

工作機會 員工故事 學生及應屆畢業生 A Dream to Perform Comes True for a Disney Intern at Hong Kong Disneyland

工作機會 員工故事 學生及應屆畢業生 A Dream to Perform Comes True for a Disney Intern at Hong Kong Disneyland -

-

-

員工故事 學生及應屆畢業生 From Disney Internships to Beyond: Meet Three Hong Kong Disneyland Resort Cast Members Making an Impact

員工故事 學生及應屆畢業生 From Disney Internships to Beyond: Meet Three Hong Kong Disneyland Resort Cast Members Making an Impact -

員工故事 學生及應屆畢業生 Disney Internships Lead to Magical Friendships and Careers at Hong Kong Disneyland Resort

員工故事 學生及應屆畢業生 Disney Internships Lead to Magical Friendships and Careers at Hong Kong Disneyland Resort -

-

-

-

-

-

-

-

工作機會 餐飲招聘日

工作機會 餐飲招聘日 -

工作機會 招聘盛會

工作機會 招聘盛會 -

-

-

-

工作機會 招聘盛會

工作機會 招聘盛會 -

-

-

-

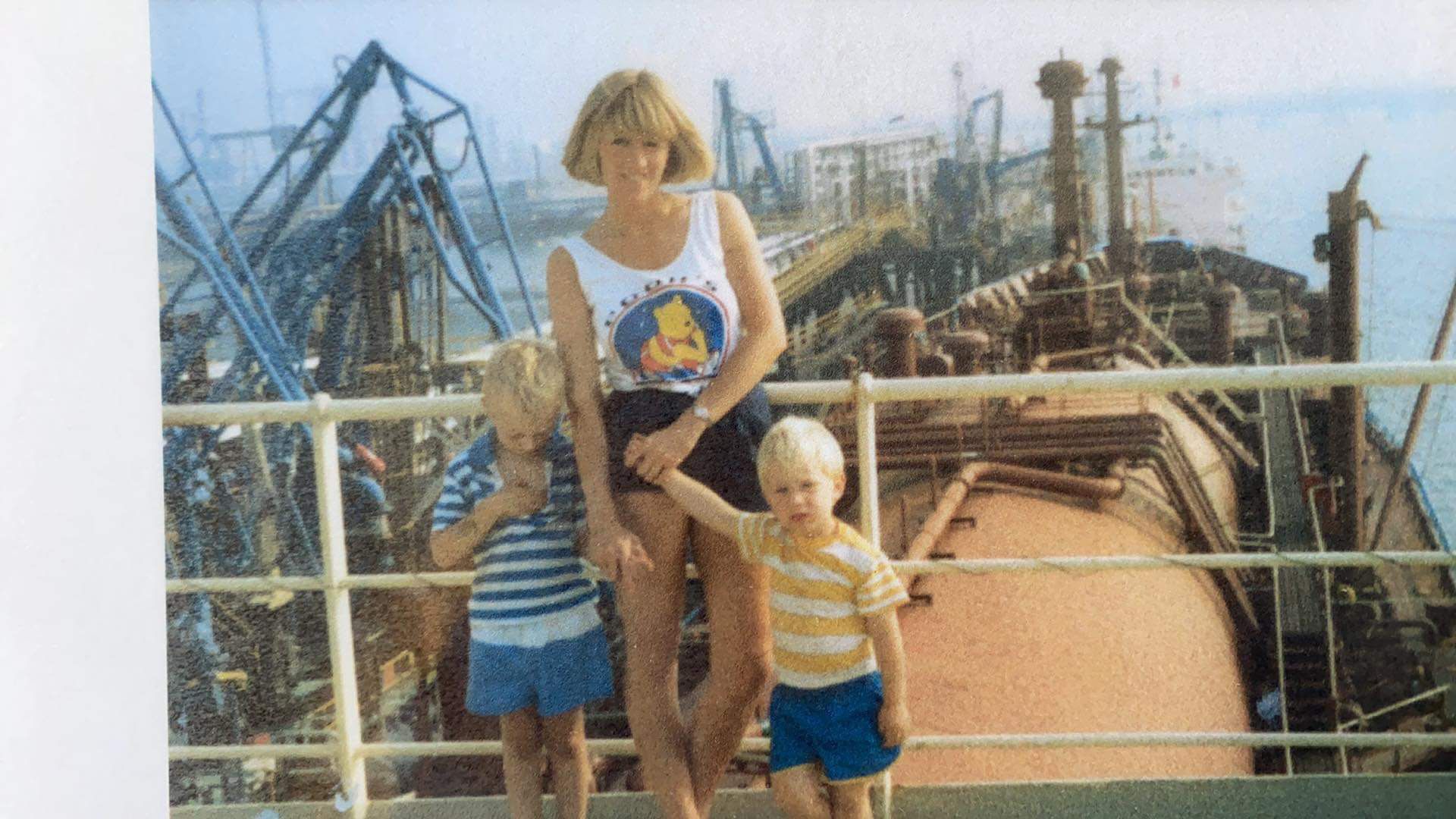

事業發展 員工故事 Disney Cruise Line’s leadership team in The Bahamas on growth, building careers, and making magic

事業發展 員工故事 Disney Cruise Line’s leadership team in The Bahamas on growth, building careers, and making magic -

-

-

-

-

-

-

-

工作資源 招聘流程 Disney Cruise Line Procurement Allies

工作資源 招聘流程 Disney Cruise Line Procurement Allies -

登記收取職缺通知

即時收到最新的工作機會的資訊。

分享

連結會在新分頁中開啟。